Payment Devices

This topic covers viewing, managing and adding new devices to Business Central

Introduction

MAX Pay Global supports a range of Payment Devices, also known as Pin Pads, Terminals, PEDs and other localized terms. Normally, but not always, they are a physical device, tag or QR code that are used to initiate and conduct the Point of Interaction with the Merchant’s customer. Using a physical device has many benefits over other methods of collecting payment, such as security, reliability, and something tangible the customer can interact with.

Device Choice

MAX Pay Global supports devices from all of the payment providers within our portfolio. A Payment Device must be of type Cloud and have a persistent and reliable internet connection. Offline payments are not supported, due to the nature of the connectivity and Business Central being a cloud hosted application. For offline payments, a Merchant is advised to have back-up communications and/or a back method of collecting a card or other electronic payment. Usually, MAX Pay Global supports all of the device families and payment methods that the provider supports via the device, but it is worth checking as this list can change and Retail Realm continually evaluates new supported and certified device as well as new emerging payment methods for compatibility.

Device Security

MPG and Business central never stores any sensitive information being collected or used by the payment device, for instance, card holder data, encryption keys, encrypted blocks of data never pass through Business Central or MAX Pay Global. All communication to and from the device is strictly between the payment provider and the device over the public internet that is serving the device and any internal network that may be part of that route.

Device Interaction

In the case where the device is orchestrating payment, the device will be responsible for the complete end to end customer payment flow, for instance, any prompts that may require user input (For instance to confirm an amount), any prompt to enter a PIN number, call to action to swipe or insert the card and so on – will be driven solely by the device and the Payment Provider.

In the case of a QR code (“Device”) or NFC Tag type device, which is passive, there is no communication as such to the device. Communication is solely from Business Central to the Payment Provider’s gateway or data center. The QR code or NFC tag is used to initiate a session on the Customer’s mobile device and the flow of the session is driven by the Payment Provider with the customer interacting to any prompts and conducting payment as necessary, within the security of their own device and using their own method of communication with the Payment Provider, e.g. SIM/4/5G or Wifi.

Communications and reliability

For Payments to be reliable and consistent, it is important that the Merchant’s environment hosting Business Central and the Payment Device have a secure, reliable and fast internet connection in order to ensure the payment experience with the customer and store associates is smooth and error free.

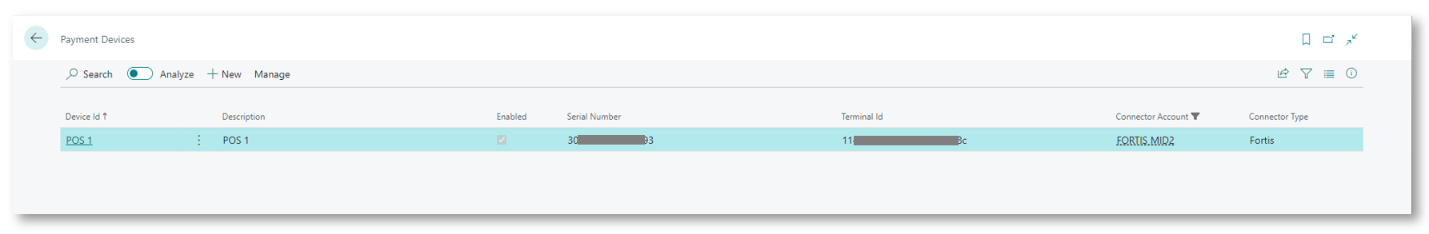

Payment Device List

To view the list of Payment Devices, navigate to Payment Devices

The list shows the Device Id, along with its enabled state, and device specific information such as Serial Number, Terminal Id and the Connector it is bound to.

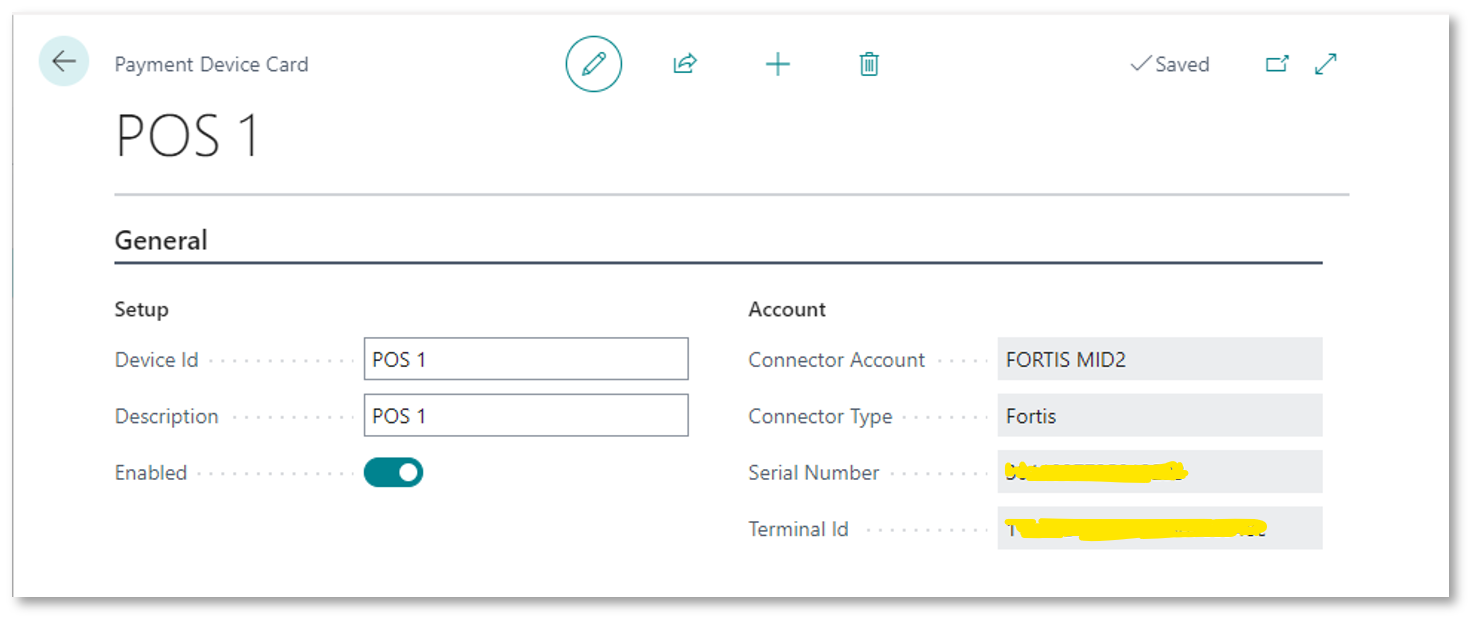

Payment Device Card

To view the Payment Device, follow these steps:

- Navigate to Payment Devices

- Select the Device you wish to view

- Select Manage > View

Edit Device

To Edit the Payment Device, follow these steps:

- Navigate to Payment Devices

- Select the Device you wish to Edit

- Select Manage > Edit

- You can alter the Device Id (Device Id must be unique across all devices) as well as the Description.

- To enable or Disable to the device, use the Enabled radio button.

- You may also delete the device. Take care – once you have deleted a device, you cannot reverse this action.

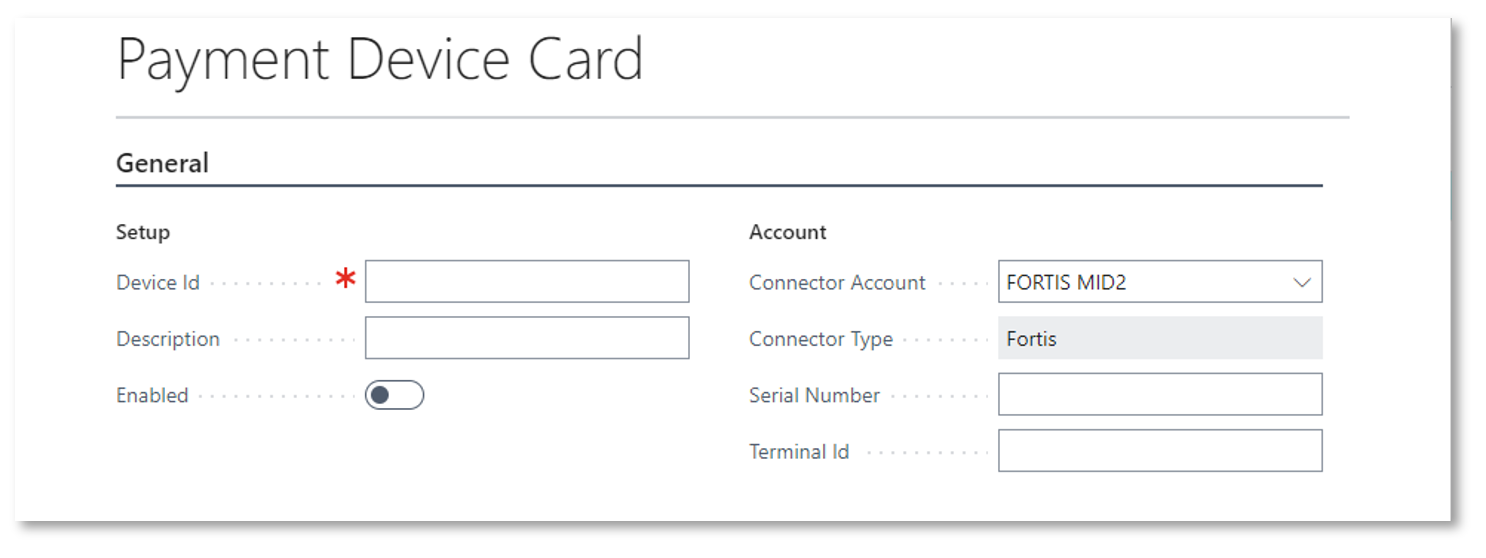

Adding a New Device

To define a new Payment Device, follow these steps:

- Navigate to Payment Connector Accounts

- Select the respective Account Id

- Manage > Edit

- Devices

Or Simply Navigate directly to Payment Devices

- Select + New

- Enter the Device Id. This must be unique. This is how the Devices will be referred to through the reports, documents and user interface when working with payments.

- Enter a description.

- Select the Connector Account you wish the Device to work with. A device can only work with a single account.

- Enter the Provider specific information, for instance

- With Fortis, Enter the Serial Number and Terminal Id of the device. Refer to your device and to your Account Representative at Fortis for this information.

- When you are ready to enable the device, select Enabled

- You can use the Back arrow when you are complete. The device should be ready to use.